App Center

VAT Tracker by Meridian

Automated, Paperless VAT Recovery

You’ve worked for every cent, we will make every cent work for you by connecting VAT Tracker to your Concur Expense and Concur Invoice and maximizing your VAT reclaim.

The benefits of choosing VAT Tracker to recover your foreign and domestic VAT:

Free Analysis

VAT Tracker will analyze your T&E and A/P expense data using its algorithm and calculate the precise VAT savings in real time.

Speed

The fastest Concur API connection with pulling speeds of 86,000 expense entries per hour.

Original Invoices Not Required

No invoices? No problem! We are committed to getting those invoices for you by working directly with your suppliers. No longer restricted to using paper original invoices, VAT Tracker can truly maximize your VAT recovery.

100% Compliance

Our compliance team will check every scanned invoice to make sure each one is 100% compliant for reclaim. We will also request reissues of original invoices where originals are still required and make sure you don’t lose out on this value.

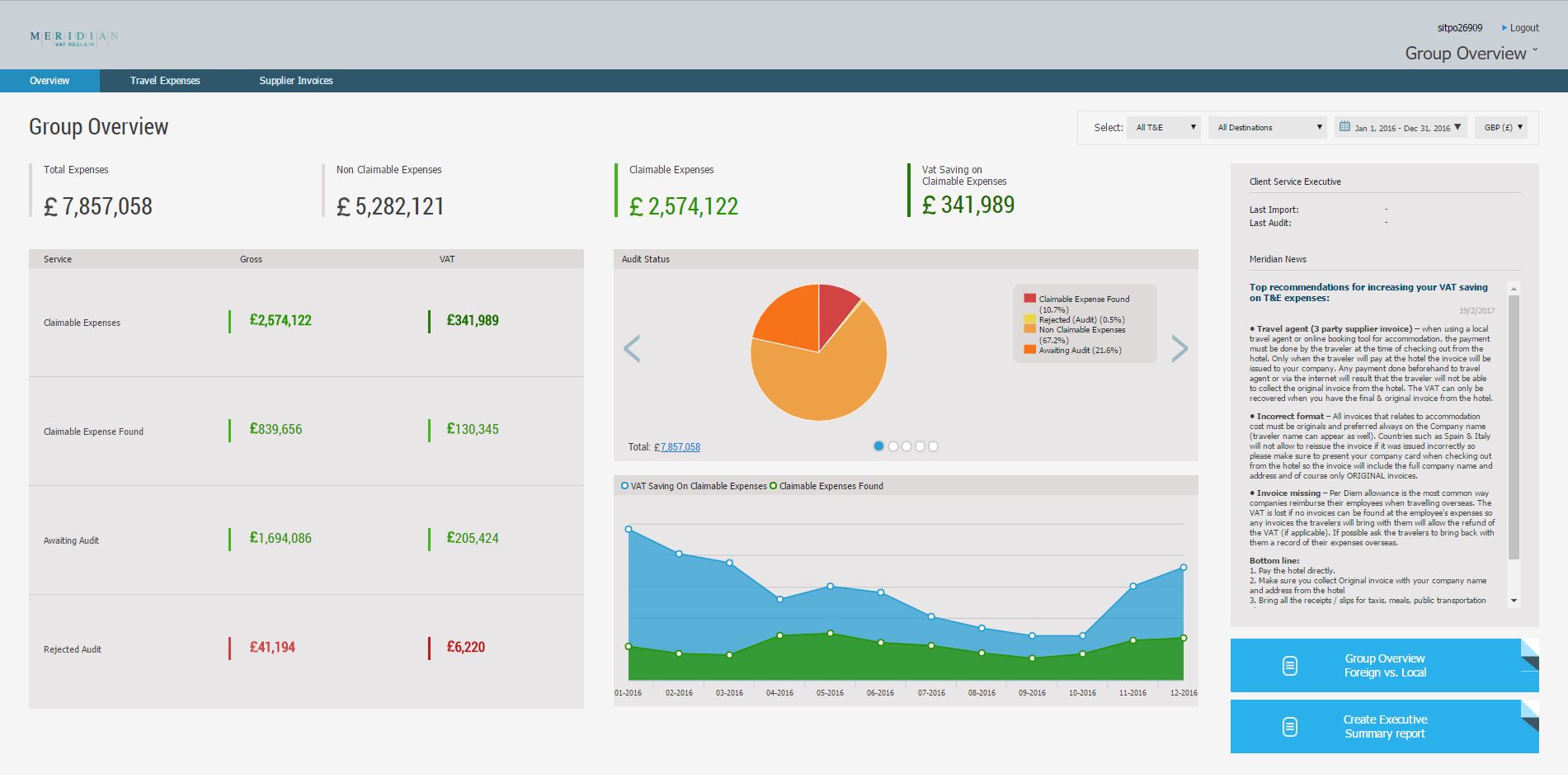

Exceptional Reporting

Review a holistic overview of your expense data by country and categorizations.

About Meridian VAT Reclaim:

Meridian VAT Reclaim, recently incorporated under The VAT IT Group, ensures automated foreign VAT maximization and compliance in an efficient, timely and transparent manner. With over two decades of experience and in excess of US$2.5 billion in VAT successfully recovered for our clients. Meridian VAT Reclaim is the world’s number one VAT recovery partner of choice to multinational, blue-chip companies worldwide. Meridian are and have been the leaders in maximizing VAT refunds for over 25 years. We continue to use our relationships, innovation and best in class processes to achieve the very best outcome for you. Combining the best technology with our services, we maximize your VAT recovery.

Request a quote or inquire about options.

Works with these SAP Concur solutions:

- Expense - Standard

- Expense - Professional

- Invoice - Standard

- Invoice - Professional

Regions Available:

- Anguilla

- Antigua And Barbuda

- Aruba

- Bahamas

- Barbados

- Bermuda

- Canada

- Cayman Islands

- Costa Rica

- Dominica

- Dominican Republic

- El Salvador

- Grenada

- Guadeloupe

- Guatemala

- Haiti

- Honduras

- Jamaica

- Martinique

- Mexico

- Montserrat

- Netherlands Antilles

- Nicaragua

- Panama

- Puerto Rico

- Saint Barthélemy

- Saint Kitts and Nevis

- Saint Lucia

- Saint Martin

- Saint Pierre and Miquelon

- Saint Vincent and the Grenadines

- Sao Tome and Principe

- Trinidad and Tobago

- Turks and Caicos Islands

- United States of America

- British Virgin Islands

- Virgin Islands, U.S.

- Argentina

- Belize

- Bolivia

- Brazil

- Chile

- Colombia

- Ecuador

- Falkland Islands (Malvinas)

- French Guiana

- Guyana

- Paraguay

- Peru

- Saint Helena

- South Georgia and the South Sandwich islands

- Suriname

- Uruguay

- Venezuela

- Afghanistan

- Åland Islands

- Albania

- Algeria

- Andorra

- Angola

- Armenia

- Austria

- Azerbaijan

- Bahrain

- Bailiwick of Guernsey

- Belarus

- Belgium

- Benin

- Bosnia and Herzegovina

- Botswana

- Bulgaria

- Burkina Faso

- Burundi

- Cameroon

- Cape Verde

- Central African Republic

- Chad

- Congo, The Democratic Republic of the

- Congo

- Cote D'Ivoire (Ivory Coast)

- Croatia

- Cyprus

- Czech Republic

- Denmark

- Djibouti

- Egypt

- Equatorial Guinea

- Eritrea

- Estonia

- Ethiopia

- European Union

- Faeroe Islands

- Finland

- France

- Gabon

- Gambia

- Georgia

- Germany

- Ghana

- Gibraltar

- Greece

- Greenland

- Holy See (Vatican city state)

- Hungary

- Iceland

- Iraq

- Ireland

- Israel

- Italy

- Jordan

- Kenya

- Kuwait

- Latvia

- Lebanon

- Lesotho

- Liberia

- Libya

- Liechtenstein

- Lithuania

- Luxembourg

- Macedonia

- Malawi

- Mali

- Malta

- Mauritania

- Mauritius

- Mayotte

- Moldova

- Monaco

- Morocco

- Mozambique

- Namibia

- Netherlands

- Niger

- Nigeria

- Norway

- Oman

- Pakistan

- Poland

- Portugal

- Qatar

- Romania

- Russia

- Rwanda

- San Marino

- Saudi Arabia

- Senegal

- Yugoslavia

- Serbia and Montenegro

- Seychelles

- Sierra Leone

- Slovakia

- Slovenia

- Somalia

- South Africa

- South Sudan

- Spain

- Sudan

- Svalbard and Jan Mayen

- Eswatini

- Sweden

- Switzerland

- Tanzania

- Togo

- Tunisia

- Turkey

- Uganda

- Ukraine excluding Crimea Region/Sevastopol, the so-called Donetsk People’s Republic (DNR) / Luhansk People’s Republic (LNR)

- United Arab Emirates

- United Kingdom

- Yemen

- Zaire

- Zambia

- Zimbabwe

- American Samoa

- Australia

- Bangladesh

- Bhutan

- British Indian Ocean territory

- Brunei

- Cambodia

- Caroline, Mariana, Marshall Is

- Peoples’ Republic of China

- Christmas Island

- Cocos (Keeling) Islands

- Comoros

- Cook Islands

- East Timor

- Federated States of Micronesia

- Fiji

- French Polynesia

- French Southern Territories

- Guam

- Guinea

- Guinea Bissau

- Heard Island and McDonald Islands

- Hong Kong SAR of China

- India

- Indonesia

- Japan

- Johnston Island

- Kazakhstan

- Kiribati

- Korea, South (Republic of Korea)

- Kyrgyzstan

- Laos

- Macau SAR of China

- Madagascar

- Malaysia

- Maldives

- Northern Mariana Islands

- Marshall Islands

- Mongolia

- Myanmar

- Nauru

- Nepal

- New Caledonia

- New Zealand

- Niue

- Norfolk Island

- Palau

- Palestine

- Papua New Guinea

- Philippines

- Pitcairn

- Reunion

- Samoa

- Singapore

- Solomon Islands

- Sri Lanka

- Taiwan of China

- Tajikistan

- Thailand

- Timor-Leste

- Tokelau

- Tonga

- Turkmenistan

- Tuvalu

- USA Minor Outlying Islands

- Uzbekistan

- Vanuatu

- Vietnam

- Western Sahara